Small and medium-sized enterprises (SMEs) in the Philippines now have free access to a powerful AI tool that can help them understand and strengthen their financial health. Kredit Hero has launched KreditLens, an AI-driven financial assessment platform designed to give businesses a clear view of their performance, creditworthiness, and growth potential.

With KreditLens, business owners can:

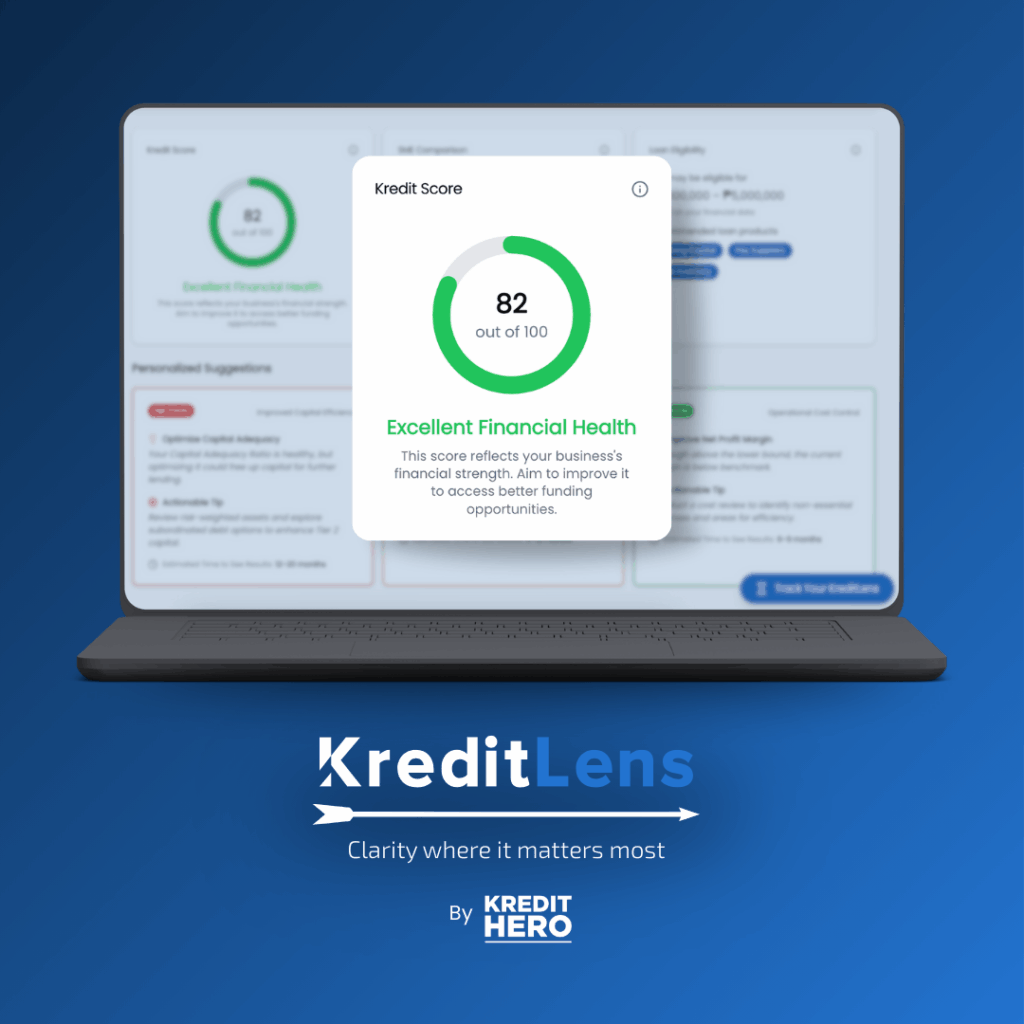

- Understand their Kredit Score (K-Score), an AI-based credit health rating built from revenue, expenses, and financial data.

- Access instant analysis by uploading bank and financial statements for a detailed performance breakdown.

- View visual insights on account activities and movements.

- Receive tailored recommendations to improve financial standing and decision-making.

- Explore loan opportunities with clear insights on approval chances.

“Financial data can be overwhelming, but KreditLens turns it into a clear, actionable report,” said Scott Moore, Co-Founder and CEO of Kredit Hero. “With this AI tool, we empower SMEs to make smarter decisions, improve their credit health, and confidently pursue growth opportunities.”

The platform, previously known as KreditCheck, now features enhanced AI analysis, smarter insights, and faster reporting. SMEs can generate monthly or quarterly reports by uploading updated financial and bank statements to track progress and refine strategies.

KreditLens is now available at no cost to all SMEs at www.kreditlens.com